Insurance Industry Trends Report 2021

Insurance Insights and News: January 2021

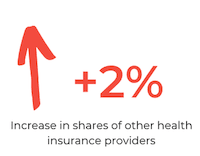

- Haven Healthcare — a joint venture between Amazon, Berkshire Hathaway, and JPMorgan Chase announced plans to shut down operations for the foreseeable future by the end of February 2021, offering traditional health insurance providers relief as the partners opt to approach their work in healthcare separately. Amazon is still expected to make major strides in delivering their own healthcare coverage to remote workers in 2021 via a partnership with Crossover Health. This news resulted in a +2% increase in shares of other health insurance providers, including UnitedHealth Group, Humana, and CVS Health.

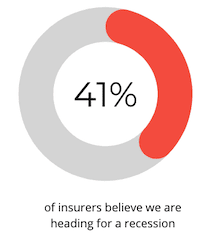

- According to the World Economic Forum, the global GDP growth has become stagnant in recent years and is expected to continue in the following years as technological innovations slow down, manufacturing rates are reduced, and consumer spending decreases. According to the Goldman Sachs Asset Management insurance survey, nearly 41% of insurers believe that there could be a recession by the end of 2021.

Insurance Trends: January 2021

Insurance agencies and financial institutions are opting out of current and future business ventures with the Trump Organization, Republican Congress, and supporters of extreme Republican beliefs as a result of their reactions to the 2020 Presidential Election, as well as the Trump administration’s handling of the riots at the U.S. Capitol building.

- Larger insurance agencies experienced an average rate increase of 11% for their auto liability policies since January 1, while general liability rates increase by an average of 6%.

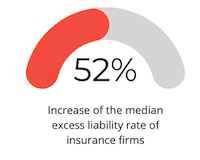

- The median excess liability rate of insurance firms has increased by 52% since the year’s start, although some policies have increased by upwards of 160%.

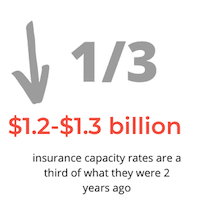

- Estimates by Lexington Insurance Co. estimate that insurance capacity rates are at a third of what they were two years, ago, which was between $1.2-$1.3 billion.

- Reinsurance rates of property and casualty insurance policies increased by 6% within the first day of 2021, which industry professionals attribute primarily to the increase in natural disasters and the COVID-19 pandemic.